What trends are shaping the camping and outdoor holiday sector?

The camping and outdoor holiday market has grown significantly in recent years, with revenue in the UK expected to show an annual growth rate of 7.6% between now and 2027. The sector saw a boost in the wake of the pandemic with domestic travel a focus, but research has shown that despite international travel returning, camping and outdoor holidays are here to stay.

We’ve taken a brief look at some of the trends impacting this sector and influencing the demand for these holidays and how consumers find and search for them.

Trends influencing the camping sector

The idea of camping is changing and therefore the results users find differ significantly based on intent. There is a wide array of choice based on destination, accommodation type and how a consumer qualifies their search for the ideal camping experience.

The main changes are driven by consumer expectations and the need for dated experiences to evolve to meet those expectations. To compound the changes, the shift in habits driven by the pandemic and then the emergence from the pandemic measures coupled with the emergence of conscientious travel, result in a complex landscape of demand.

Here are a few top-level patterns we’ve seen in this sector:

- Searching for a camping holiday abroad can return a very different experience to searching for a camping holiday in the UK.

- Glamping is changing the camping landscape for traditional campsites and accommodation providers.

- Customers are looking for unique accommodation in unique settings.

- Holidays camps are vastly different to campsites, although the two are drawing closer together.

- The market is becoming more fragmented – with more variation in camping and outdoor holiday type and experience than ever before.

The differing layers of intent to camping searches

To demonstrate the level of fragmentation in the market, we’ve looked at the differing intent behind searches to camp in the UK vs. abroad.

1. Searches to camp in the UK

If a consumer is looking to go camping in the UK, the search needs to be specifically qualified in relation to the type of experience they want.

Searching for ‘campsites’ naturally results in traditional campsites. As soon as this is broadened to ‘camping’, a wider definition of the term starts to come into play as well as camping equipment results and some local results.

2. Searches to camp abroad

Searching abroad, a search term such as ‘camping in France’ results in a less traditional camping result. The top results are what the UK would consider Holiday Parks with a mixture of accommodation types and features including water parks.

The expectation of a holiday camping abroad is a much broader solution to the intent reflected for searches closer to home.

Intent must be more defined with descriptive searches

For consumers, understanding the options for camping holidays and finding the right match within a crowded market comes down to being descriptive. A few ways to narrow down the results to find specific holiday types include:

- Holiday Parks – These results include classic British holiday parks such as Park Dean Resorts, Hoseasons and Pontins.

- Campsites – Searching for campsites leads to traditional pitch-based sites as featured on Campsites.co.uk and Pitchup.

- Camping – Broader traditional sites including Haven and The Caravan Club are captured in camping searches. They also feature with price sensitive searches such as ‘cheap camping’.

- Accommodation – There is a growing trend to find alternative camping accommodation, moving away from the traditional, driven by sites like Airbnb. This has led to an increase in features on unique accommodation to draw customers into more traditional sites.

Merging solutions: Glamping it up

Many providers have diversified their offering to capture a renewed interest in camping whilst catering to specific needs driving that renewed interest. Glamping offers an alternative to campers ensuring that some essentials are covered in the experience taking some of the work out of traditional camping.

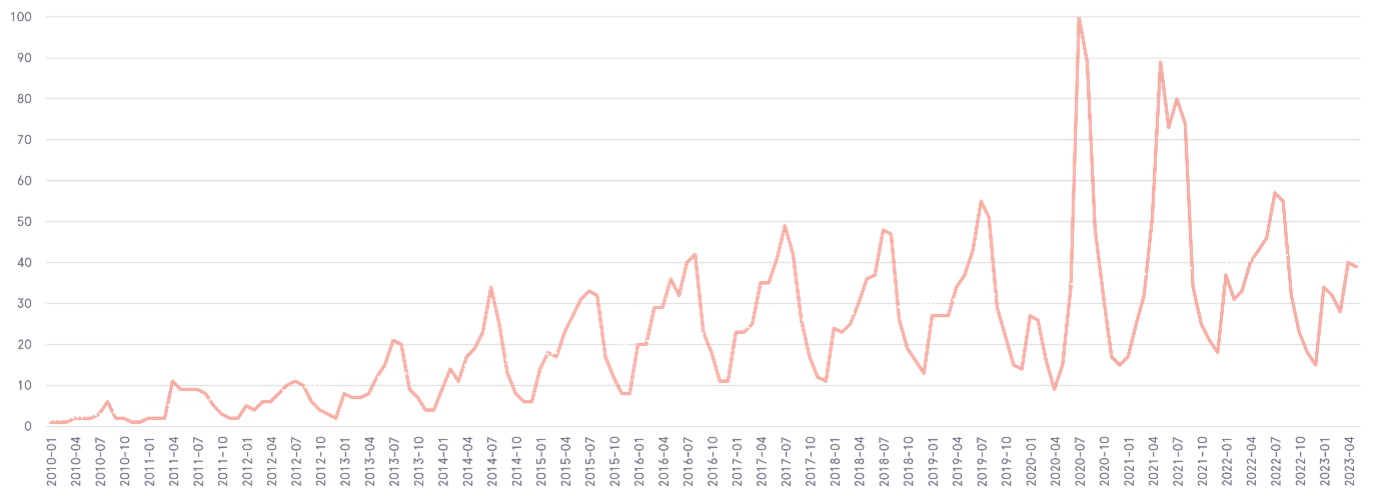

Searches for glamping have consistently increased over the last decade, peaking in 2020 and 2021 due to demand generated in the pandemic in between lockdowns. Every type of camping provider has diversified to have a glamping option from traditional campsites and holiday parks to new providers including farmers and landowners diversifying their land use.

Wider socioeconomic concern about the climate crisis, as well as a rising interest in personal wellness and the impact nature can have on this means glamping is an interest we’re likely to see for some time to come.

‘Glamping’ search trend

Staycations and glamping searches may be the main result of increased demand, but customers are also looking for unique accommodation. Airbnb has captured this in its main navigation and other providers are building out content around a more diverse range of accommodation types and camping features, such as hot tubs.

Escape: Whilst staying connected

Expectations of the experience and features are continuing to grow. Campers want to be able to escape and experience a wilder vacation whilst retaining home comforts reflective of today’s lifestyle.

- Wi-Fi to connect to social media and broadcast your unique experience with the option to work remotely reflecting the work from anywhere lifestyle.

- Fire pits to extend the outdoor living and romanticising of the wild camping experience.

- Connecting to nature, wellbeing and sustainability.

- The continuation of the staycation; consumers are looking to continue their discovery of destinations close to home.

Looking ahead for the camping and outdoor holiday sector

Overall, this is a sector that will continue to see a rise in demand – in the short term, not least because the cost-of-living crisis will squeeze budgets on international travel, particularly for families, but wider than this – this is a sector with a strong connection to wellness, wellbeing, the climate conscious, and the age of the experience economy.

But, as this demand grows and reaches more demographics than it traditionally once did, so too does the amount of options and varying experiences people are looking for.

Essentially, brands in this space need to be acutely aware of the audiences their type(s) of holiday offering attracts, and align this with a strong understanding of how those audiences are finding and searching for them.

If you’d like any support understanding and reaching the right audience for your offering in this space, get in touch to explore a market discovery project where we’ll outline the biggest opportunities for you to take advantage of this growing demand.

Latest Insights From The Team.

Explore our team’s latest thoughts and actionable advice from our blog to support your digital marketing strategies.