What does it take to perform organically in the vitamins and supplements sector?

With a rise in health consciousness in recent years, it’s not surprising that the online vitamins and supplements sector in the UK has grown, too. This industry is worth around £695m (source: IBISWorld) and with close to 2.6m monthly searches relating to this sector, how can brands in this space compete for organic traffic?

We’ve taken a dive into the top organic performers to uncover what it takes to gain a good organic market share for relevant searches.

The past year has obviously also created a shift in consumer behaviour, with increased online traffic and sales and a great deal of conversation around health. So, with that in mind, we’ve identified a number of growing trends, discovering growing interests and search terms that brands in this sector should be paying attention to.

Uncovering trends in this industry

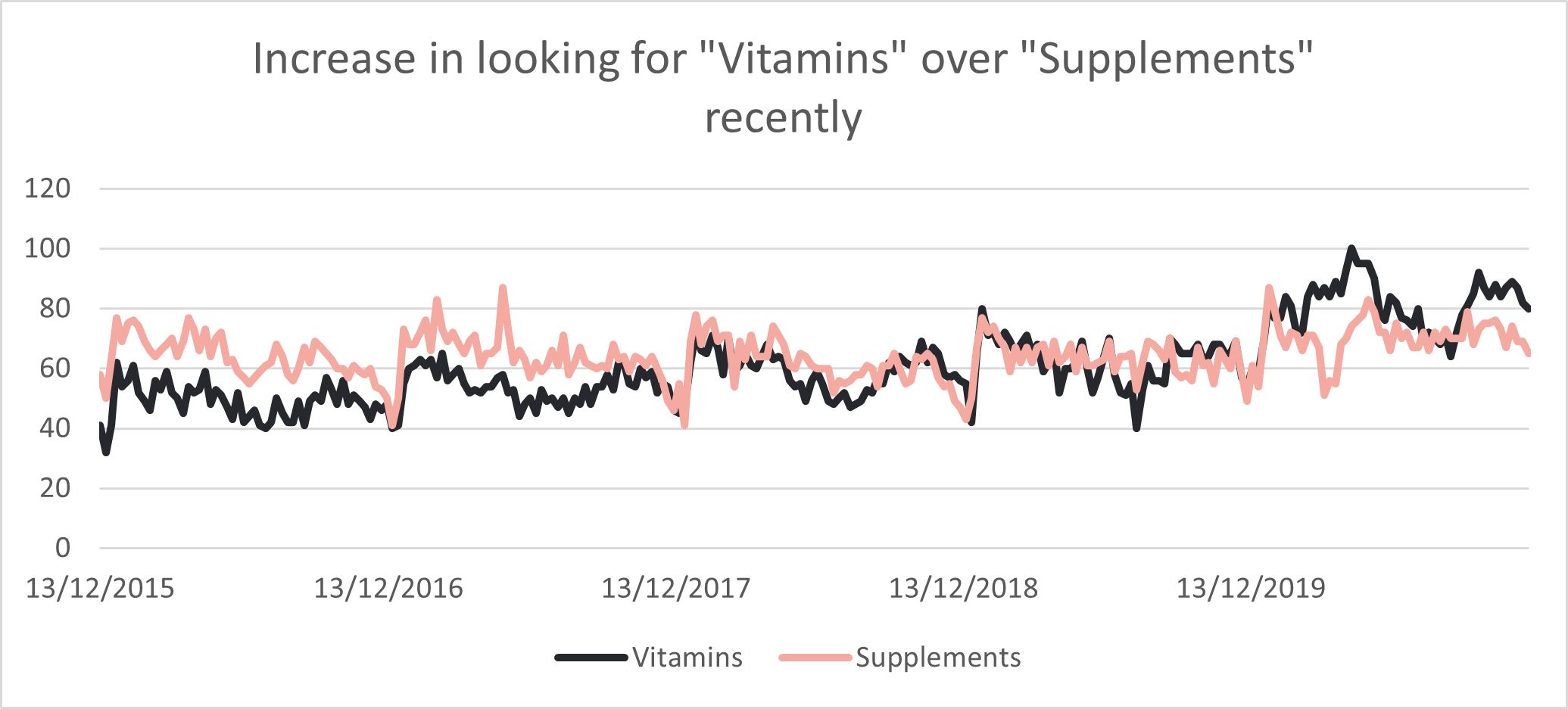

Searches for “vitamins” overtook searches for “supplements”

In an interesting shift, when the first lockdown hit the UK in March, searches around “vitamins” overtook those around “supplements”:

It’s likely that with gyms closing, searches around supplements that align strongly with the exercise and fitness industry weren’t as popular as those around vitamins to stay healthy and well. This is a trend that continues now as we’re in the midst of our third lockdown, so one that this industry should be mindful of when targeting search terms.

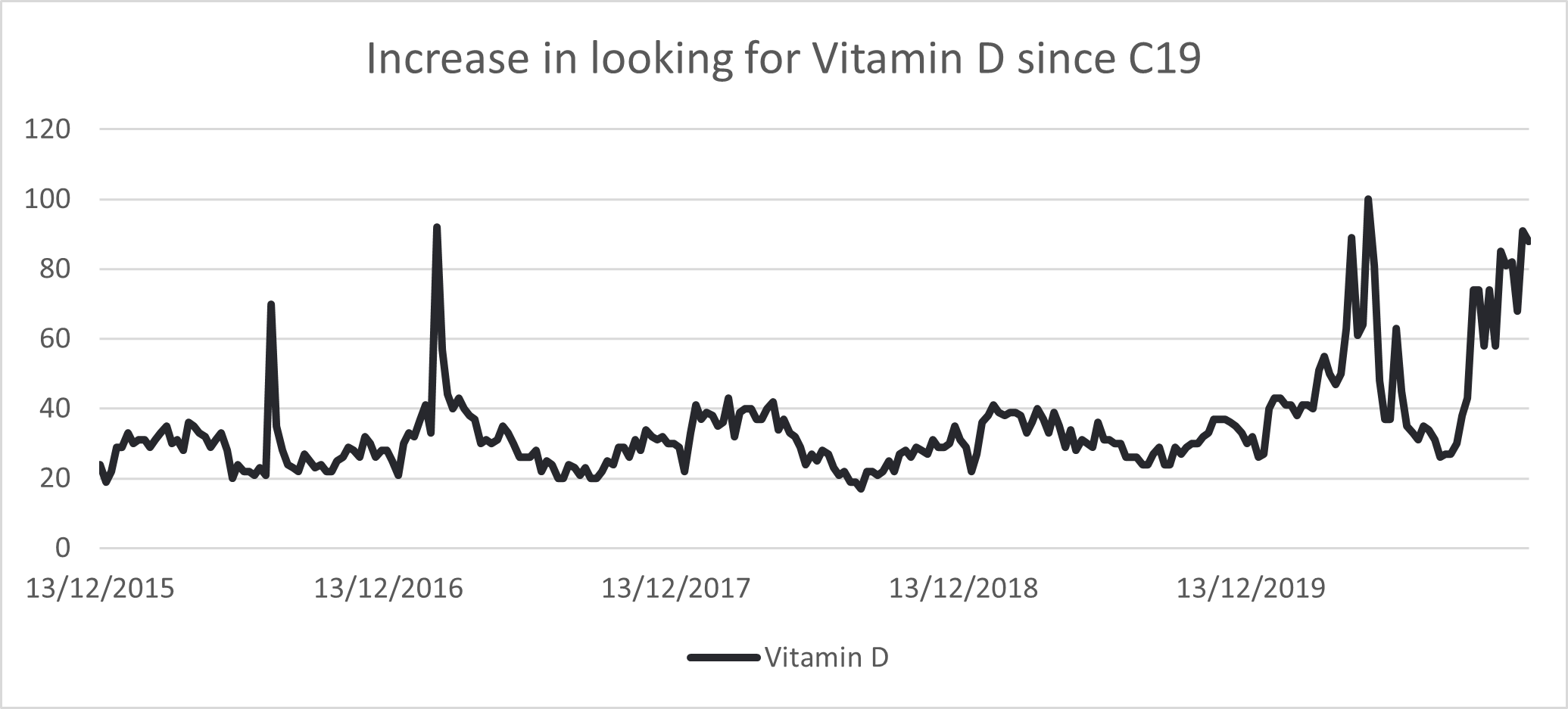

Vitamin D grew in demand

Vitamin D has featured heavily in the news since the start of the first lockdown with plenty of conversation around whether it helps you fight off COVID-19, so it’s unsurprising to see a boost in searches for this.

Searches have remained high and UK citizens are often short on Vitamin D anyway due to our long Winter nights, so if you have content around Vitamin D that you can update and push out once more, or if you need to create some; now is the time.

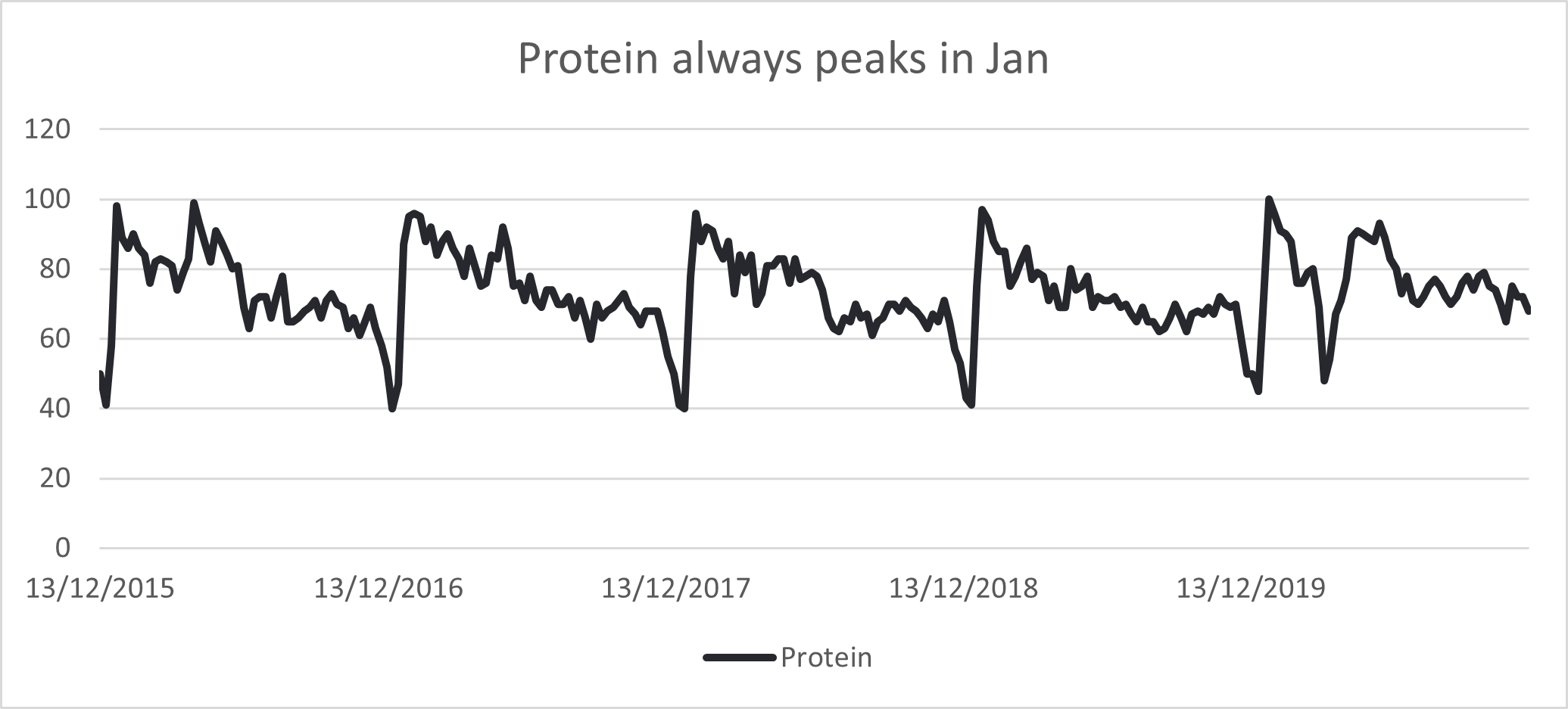

Protein searches increased outside of usual seasonality

Searches around protein always peak in January, alongside a push for many to concentrate on their health and fitness, but interestingly in 2020 it also saw a peak in lockdown.

Perhaps as people were stuck at home, they looked for ways to stay fit and healthy with their nutrition and diets to balance out the lack of gyms / fitness classes. This is an interesting one to keep an eye on right now as interestingly, protein products have high margins, so expect to see the competition placing more focus here this year.

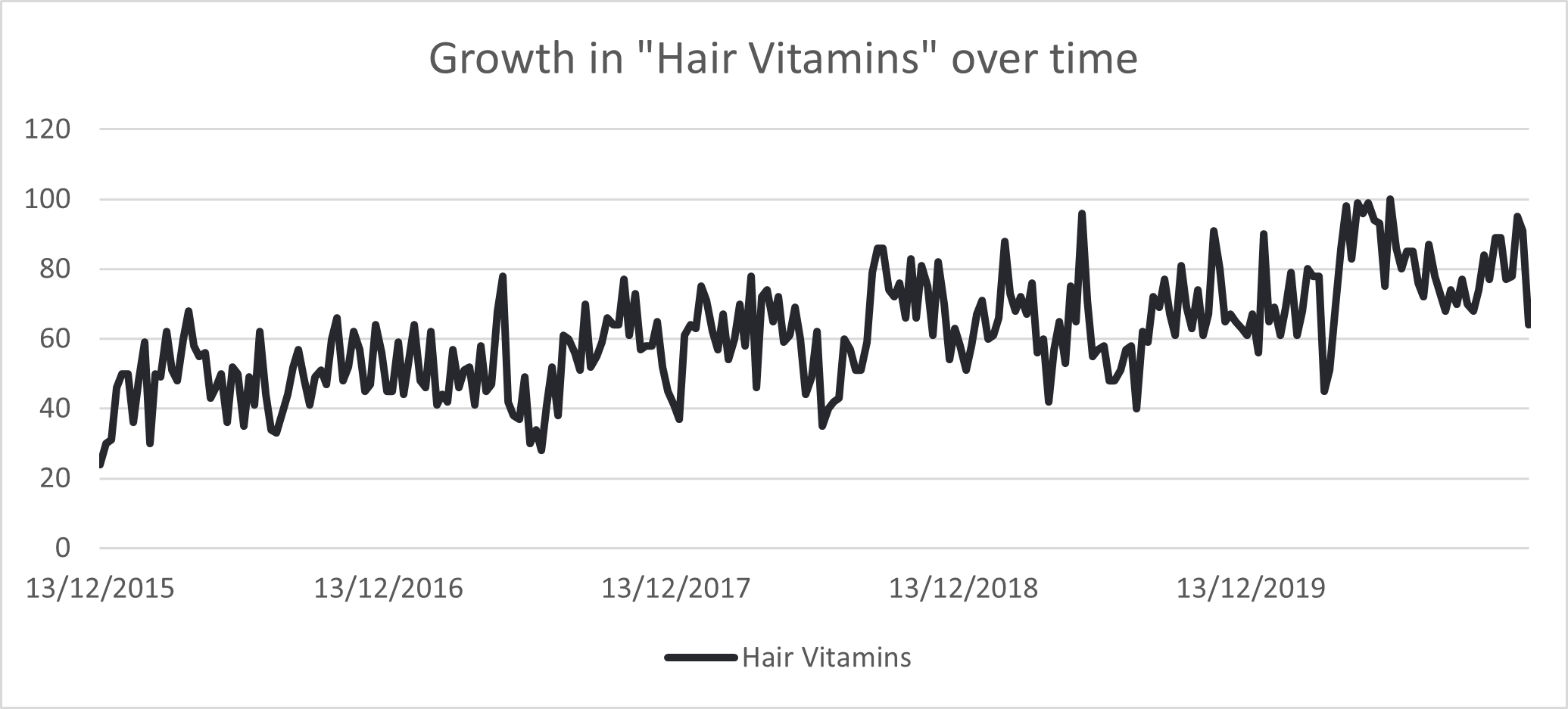

Growth in “hair vitamins”

This saw a big peak in the height of the first lockdown, too. We know that self-care was a big focus for many as we navigated our way through an uncertain and largely stressful three months at home, so it’s likely this ties into a boost for wellbeing.

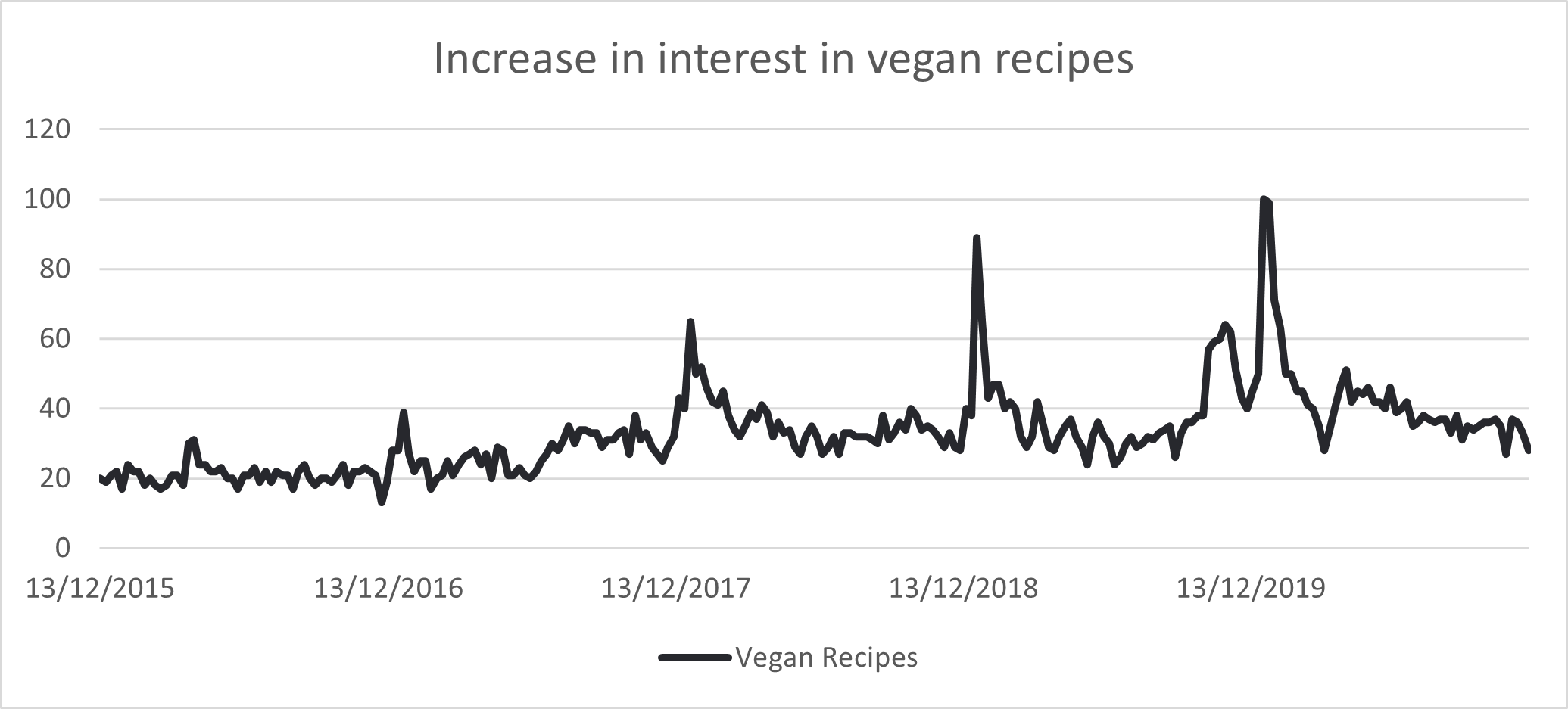

Rise in interest around vegan diets

This is certainly something to be mindful of when looking at the year ahead. There’s been a steady rise in the interest surrounding vegan diets, and with this, comes a need for supplements and vitamins alongside the diet to replace iron, protein and B12.

A dive into the top online performers

Let’s have a look at the brands dominating the organic space for searches around vitamins and supplements:

Overall visibility

| Brand | Traffic Value Est. | Visibility (SearchMetrics Jan 2021) |

| Holland and Barrett | £110,752 | 43,317 |

| My Protein | £59,815 | 7,684 |

| Bulk | £24,078 | 658 |

| Boots | £22,123 | 159,711 |

| Health Span | £13,247 | 3,024 |

| Superdrug | £10,940 | 76,078 |

| Tesco | £7,181 | 255,198 |

| BodyBuilding | £5,842 | 8,715 |

| Lloyds Pharmacy | £3,884 | 23,615 |

| Asda | £2,154 | 212,300 |

| Sainsbury | £1,340 | 159,800 |

| Simply Supplements | £1,218 | 1,083 |

Ranking positions for vitamin and supplement terms

| Brand | Keywords ranked for (out of 104) |

| Holland and Barrett | 100 |

| My Protein | 79 |

| Boots | 54 |

| Health Span | 47 |

| Tesco | 45 |

| Superdrug | 31 |

| Sainsbury | 26 |

| Lloyds Pharmacy | 26 |

| Simply Supplements | 25 |

| Asda | 21 |

| BodyBuilding | 17 |

| Bulk | 17 |

What’s clear to see from looking at broader visibility across all terms, and then niche rankings within a keyword set just based on vitamin and supplement terms; Holland & Barrett is the competitor to beat.

From a niche view, this is understandable as they have a much broader product range across vitamins, healthcare and supplements, as opposed to those just behind them – My Protein and Bulk – who focus much more on the supplements market.

So, let’s dig into some elements of their organic performance to see why some brands have more market share than others.

Site speed

| Brand | Load Speed(s) |

| Tesco | 0.65 |

| Boots | 0.69 |

| Sainsbury | 0.69 |

| Asda | 0.69 |

| Simply Supplements | 1.31 |

| Health Span | 1.40 |

| Lloyds Pharmacy | 1.47 |

| Holland and Barrett | 1.58 |

| My Protein | 1.69 |

| Superdrug | 1.85 |

| Bulk | 2.05 |

| BodyBuilding | 2.87 |

We know very slow site speed is a ranking factor and with Google recently announcing an algorithm update focused on page experience to roll out this year, it’s essential to look at site speed as a signal that Google will use to measure user experience.

What we can clearly see is that the big supermarkets have invested heavily in site speed, but there’s clearly something the niche brands are doing better to boost them above.

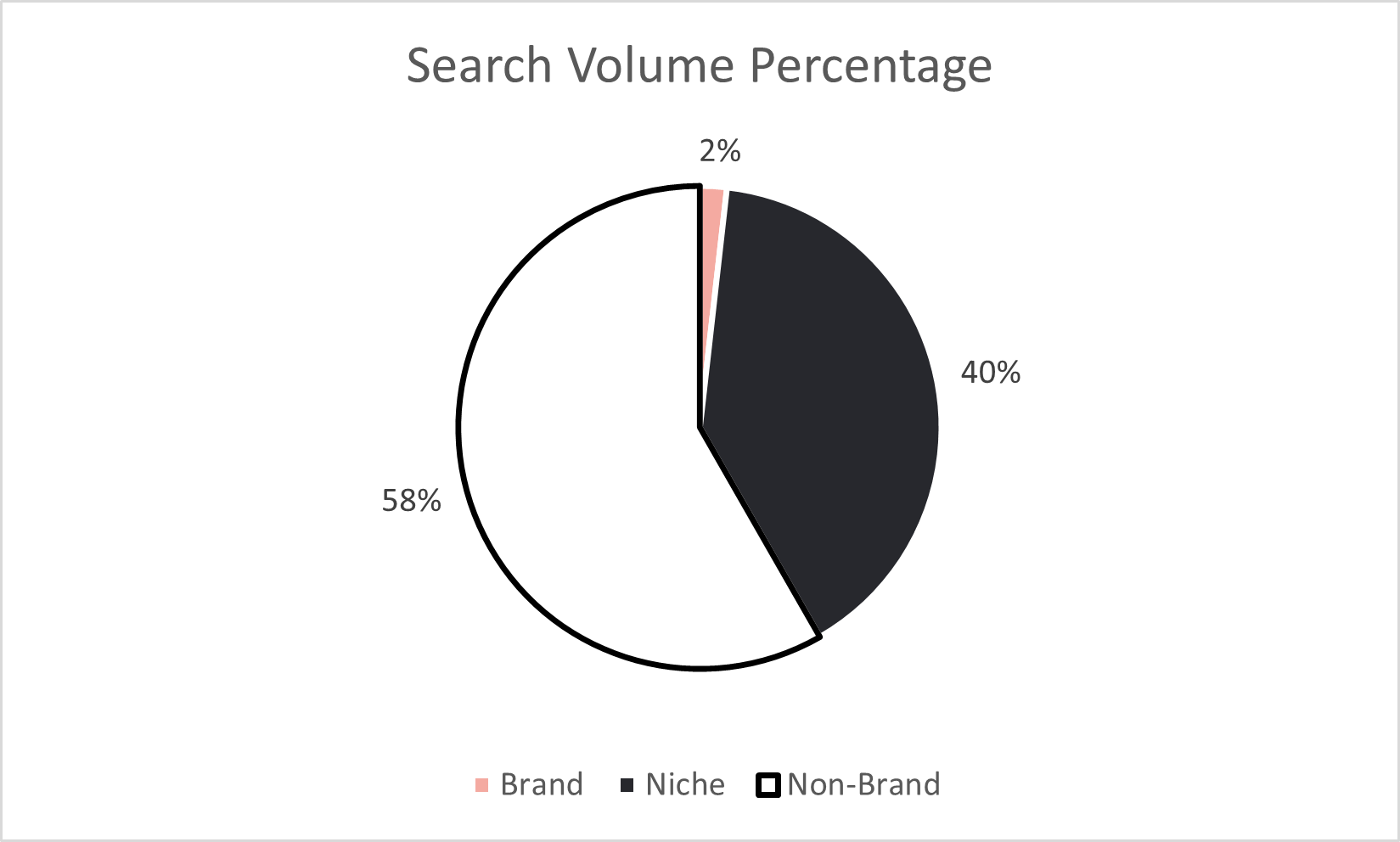

How much does brand factor?

We know that since the pandemic, people have been more inclined to stick to the brands they know and trust. Has this been reflected when we look at brand search volume? Here, we looked at brand search volume for niche vitamin and supplement companies as a whole, and then for the bigger multiline retailers i.e. Tesco, we looked at brand + vitamins, i.e. “Tesco vitamin D”.

| Brand | Company Type | Branded Search Vol* |

| Holland and Barrett | Niche | 1,200,000 |

| My Protein | Niche | 362,600 |

| Bulk | Niche | 93,400 |

| Health Span | Niche | 58,200 |

| BodyBuilding | Niche | 49,500 |

| Boots | Brand | 43,000 |

| Simply Supplements | Niche | 16,700 |

| Tesco | Brand | 13,500 |

| Superdrug | Brand | 11,300 |

| Asda | Brand | 7,600 |

| Sainsbury | Brand | 3,500 |

| Lloyds Pharmacy | Brand | 1,000 |

*See details above.

What we can see here is that when we take keywords into account, people search much more for niche vitamins and supplement companies, rather than the supermarkets or big pharmacies. This brand association shows the value in being a specialist retailer; while people may pick up vitamins at Tesco as part of their weekly shop, they are unlikely to consciously choose Tesco when they look for a specific vitamin or when shopping online.

Non-brand rankings

When we look at the top 20 non-brand searches in the UK, who’s ranking top for these?

| Keyword | Search Volume | Top |

| vitamin d | 201,000 | Holland and Barrett |

| fat burner | 90,500 | Holland and Barrett |

| bulk powders* | 90,500 | Bulk |

| vitamin c | 74,000 | Holland and Barrett |

| vitamin b12 | 74,000 | Holland and Barrett |

| protein | 60,500 | Holland and Barrett |

| protein powder | 60,500 | My Protein |

| echinacea | 49,500 | Holland and Barrett |

| chia seeds | 49,500 | Holland and Barrett |

| magnesium | 49,500 | Holland and Barrett |

| protein shakes | 49,500 | My Protein |

| coconut oil | 49,500 | Holland and Barrett |

| spirulina | 40,500 | Holland and Barrett |

| whey protein | 40,500 | My Protein |

| collagen | 40,500 | Holland and Barrett |

| creatine | 40,500 | My Protein |

| vitamin d3 | 40,500 | Holland and Barrett |

| biotin | 40,500 | Holland and Barrett |

| b12 | 33,100 | Holland and Barrett |

| vitamin e | 33,100 | Holland and Barrett |

*bulk powders is a brand and non-brand product

Again, Holland & Barrett is dominating, and what’s interesting is that they’re even ranking above the niche protein supplement companies for “protein”, and above supermarkets for products that are also cupboard items like “chia seeds” and “coconut oil”. We cover why this might be a bit further below.

Referring domains

| Brand | Referring Domains | Backlinks |

| Tesco | 53,439 | 8,614,384 |

| BodyBuilding | 44,290 | 3,033,838 |

| Boots | 39,901 | 10,209,919 |

| Superdrug | 19,821 | 664,523 |

| Sainsbury | 18,307 | 37,167,514 |

| Holland and Barrett | 11,067 | 1,009,527 |

| Asda | 8,235 | 3,038,411 |

| Lloyds Pharmacy | 7,237 | 21,283,500 |

| My Protein | 5,936 | 496,145 |

| Health Span | 2,256 | 58,139 |

| Simply Supplements | 1,394 | 18,601 |

| Bulk | 637 | 11,980 |

Whilst the niche companies hold the share of the market, when we look at backlinks and referring domains the supermarkets and big pharmacies lead. However, as we’ll go on to discuss below, it’s likely that many of these aren’t relevant to vitamins and supplements searches.

So, what does it take to be visible in this industry?

With all of this in mind, what are the factors ranking Holland & Barrett and other niche companies above the bigger brands?

To break into this market as a multiline retailer will be difficult as brands tend to rank for generic terms, and if people search for branded terms they are for niche brands (i.e. Bulk Powders) not more generic brands (i.e. “Tesco Vitamins”).

It’s also worth noting that non-retailers – e.g. health magazines – rank fairly well in this sector, often above retailers, as this is a market with a lot of informational intent around searches:

- What is vitamin b12?

- Why do I need vitamin C?

- What is the best way to get this into my diet?

- What if I am vegan, or have other dietary requirements?

And what we can see from those niche brands performing at the top, is that they serve these informational searches, too. Having high quality content featuring core selling points and answering these queries is an element of the top performing brands we’ve looked at.

Google clearly favours relevance of content. Even within niche brands, BodyBuilding has a vast amount more referring domains than Holland & Barrett, yet Holland & Barrett performs better in this sector.

Holland & Barrett’s navigation and landing pages are incredibly granular. They’ve made it easy for Google to see the right page to rank for a lot of terms in this niche, and it’s right at the front of their navigation, too.

The brand has seized the trend on Vitamin D as well – with a whole hub dedicated to it. Their combination of extensive supplementary content and landing page structure has resulted in this market dominance – of course, their bricks and mortar presence and brand recognition will play a big part, but that on its own without the technical and content foundation of their website wouldn’t be so effective, as demonstrated by the supermarkets.

Despite its low search volume, Lloyds Pharmacy has more relevant content and products onsite than Asda. This is real missed opportunity for Asda, who would likely only need to boost their pages to outperform, e.g.

- https://groceries.asda.com/aisle/health-beauty/health-medicines/vitamins-supplements/106483 compared to:

- https://lloydspharmacy.com/pages/vitamins-supplements)

Whilst the big supermarkets look to have invested in site speed, without relevance and content to support a niche it isn’t enough to boost them ahead of more relevant brands.

Key takeaways

- In this sector, relevant content is essential. Because vitamins and supplements are so closely related to health, there are a lot of informational and research-based terms to rank for. High quality, detailed and expert content is essential to widen visibility across these longer tail terms, as well as providing the user experience and trust needed to move users along.

- With Google’s Core Web Vitals algorithm update coming this half of the year – signals such as site speed need to optimised as much as possible, the big multiline brands do this well but the niche brands need to catch up.

- It’s incredibly important to stay on top of trends – with health an obvious focus for many right now, it’s essential to know month to month what your audience is looking for and the types of questions they’re asking, so you can adapt your content and strategy and position yourself above the competitors.

If you’d like any support with your own digital marketing strategy or would like to know more about how you’ll fare when the Core Web Vitals update is rolled out, get in touch for a chat about how we can help.

Latest Insights From The Team.

Explore our team’s latest thoughts and actionable advice from our blog to support your digital marketing strategies.