[REPORT] The Trends That Matter: Home Furnishings

Definition of the sector

There’s no place like the home furnishings sector. After a rapid boom in making our houses as comfortable as possible while we were all stuck at home during Covid, how has the sector adapted to both the return to work and the recent economic downturn in the UK?

To find out, we analysed what digital success looks like across the sector and which organisations are standing out.

The sector is vast, so we have initially defined it by looking at the top search performers across bedroom, living room, dining room, kitchen, office, lighting, storage and home décor. With the kitchen category, we have only looked at kitchen furniture and not at the extensive market for kitchen units and kitchen design. Similarly, we have only looked at home décor in terms of individual items and have stayed clear of the blinds and curtains market as this is very much a separate entity. The conclusion of our analysis is therefore a compact view of the landscape of organisations we use to furnish our homes.

The results are a blend of expected outcomes showing the dominance of some major retailers, along with a few unanticipated conclusions highlighting opportunities within a broad and fragmented market. So, without further ado, let’s dive in.

Methodology of Analysis

To grasp the scale and breadth of the market we have analysed around 13,000 keywords across eight categories (bedroom, dining room, home décor, kitchen, lighting, living room, office and storage). The analysis has captured the predominance of websites ranking across both the whole keyword set and at category level. We have looked at brand scale and social following across the top performing brands from the initial keyword analysis. Following this initial broad view across the market, our objective was to draw out common patterns and unique insights based on the specific digital activity and strategies of the more successful organisations. As part of this analysis, it was important to look at company objectives and how they relate to wider market trends and consumer behaviour patterns.

What’s happening in the sector?

Home furnishings is still adapting since the large-scale impact of the pandemic. Although most sectors were significantly impacted during that time, the furniture sector had many contrasting waves of change and the ripples of that period are still shaping things today. In fact, what’s remained clear through our research is that the home furnishings sector is still going through a period of recalibrating.

The pandemic exposed vulnerabilities in supply chains with materials being sourced from all over the world. This increased demand put a strain on a workforce having to adapt working practices to satisfy demand and the impact of social distancing and illness. The balance in how we invested in our homes shifted as we spent more time there for both work and pleasure. We reconnected with our homes in new ways, investing in a lasting quality and aesthetic with a more conscientious vision for the world around us. This resulted in heightened competition across the sector, which was most emphasised online, being delivered through improved service and more competitive pricing.

As we’ve moved further away from being in the depths of a pandemic, the most significant impact off the back of this era now, is how it has implanted strong consumer behaviour practices which are unlikely to revert or change for some time. The desire for fast home furnishing fashions has slowed, while the expectation for a heightened service and quality is here to stay. The multi-functionality of the home – for both work and leisure – is also consistently prominent, which is leading to continual demand for home office products and home décor to improve the overall environment people spend more time in. There are opportunities in these newer verticals within the sector as well as a shake up with some established businesses.

The consumer is more informed than ever as they continue to take control of their purchasing decisions by gathering information online. Brands’ ability to build trust and confidence with consumers through a consistent on and offline experience, coupled with advocacy from a wider community (including reviews), is critical for ongoing success. Our analysis shows that there is no room for token gestures or box ticking in such a fragmented and competitive sector. If a brand is present in any channel, they need to be active and resonate with their audience to drive meaningful value and growth. An inactive approach can potentially be damaging for a brand in what is a testing economic period.

The cost of living crisis is continuing the contrasting waves of change within the sector. Consumers still have the desire to create the best home environment they can but the ways in which they are doing so is changing. There is a focus on smaller furnishings to make a comfortable space more luxurious, such as house plants or cushions. Consumers also have a heightened awareness on home efficiency which is manifesting in spend across smarter furniture and appliances. Spaces need to offer flexibility as well as comfort, so statement pieces are being mixed with modular and changeable furniture and storage solutions. The traditional objective of making a house a home is shifting and diversifying across different audiences, from students and young adults to families and multi-generational homes.

This is leading to a market full of opportunities with a wide range of companies in the position to focus and make the most of these opportunities. There is stagnancy in the sector so brands need to tune in and respond to carve out further patterns of growth over the next decade.

Market Positioning and Share: Who owns the market?

Search Market Share

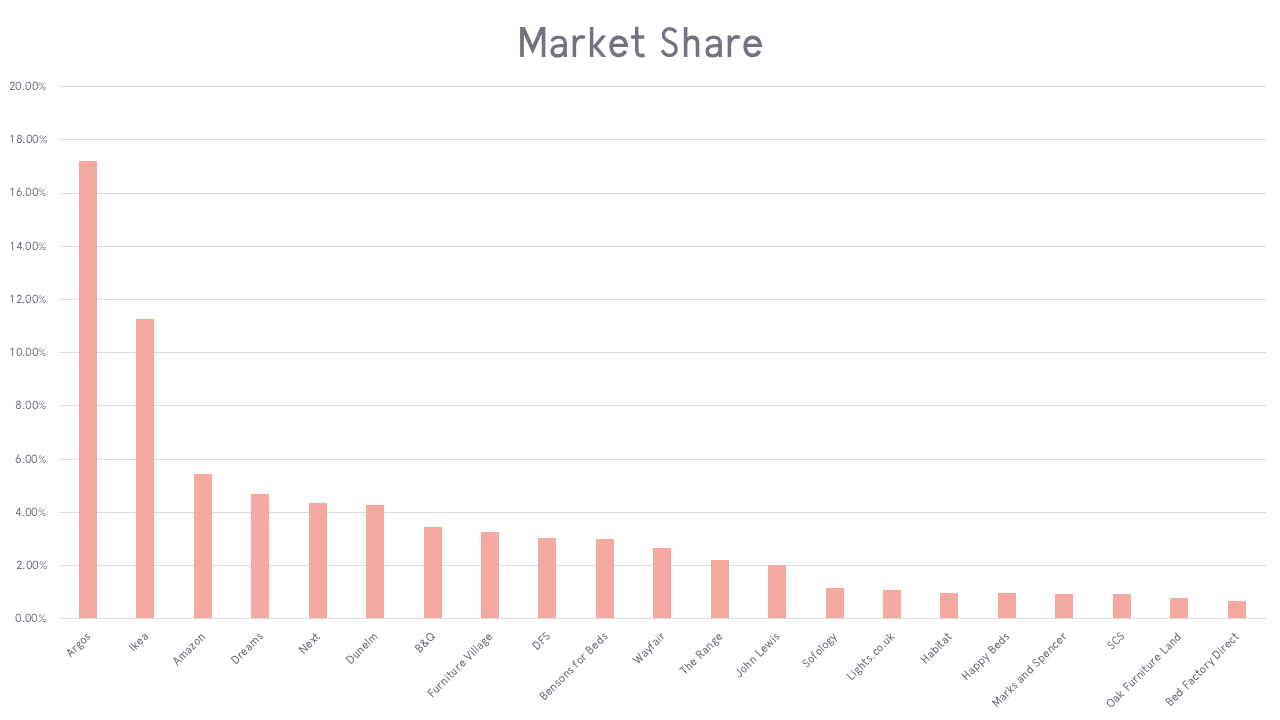

Before analysing the keyword landscape, we had an expectation on which organisations would dominate the sector. We were not surprised by the overall market share results across the ~13,000 keywords but there were some intriguing outcomes at individual brand levels.

Looking at market share for the top 21 brands across the sector, Argos is by far the dominant brand. This is achieved by both breadth, with only Amazon and Wayfair ranking for more keywords from the sample, and strength, with almost 71% of terms in a top 10 position. This dominance from Argos is impressive for such a broad and competitive sector. While Amazon has shown that a broad product range can drive general dominance, Argos has taken this to another level across the bedroom, living room, office, and storage categories.

Ikea have a similar strong, broad performance across the whole category set, the difference being that they don’t own any one particular category. We’ll discuss Ikea in more detail later in the report as the brand’s strength comes down to understanding their audiences.

On the whole, the leading organisations within the sector are made up of the large multi-category retailers as well as category specialists, including Dreams, Furniture Village and Bensons for Beds. Habitat is relatively unique within the top set of organisations as it stands on its own as a general furniture brand without working as a marketplace or selling other brands under its own brand umbrella. The bedroom category carries more search demand than the other categories included, which reflects why some of the bedroom specialists have a strong overall position across the sector landscape.

Each category does have a set of specialist retailers in amongst the larger multi-category retailers, yet what is clear is that it is difficult for these brands to cut through and dominate in the category in the same way. Lights.co.uk are a strong example of a category leader with a very well optimised search and customer journey and a thorough taxonomy and authority across the lighting category.

The whole sector is full of furniture specialists trying to find their search position within the market whilst optimising in very similar ways. How do organisations differentiate their proposition whilst still appealing to a wide audience with a wide range of products? We’ll delve into this challenge further into the report; however, we will need to look wider than search market share alone to truly understand the sector.

Action that matters: In order to grow market share, organisations need to focus on building authority at a category level. Your initial focus should be on identifying and optimising one or two key categories with very relevant supportive content with commercial intent, as well as building authority specifically to those categories. Your aim should be to establish a robust, targeted category authority which can be replicated across the product range.

Social Scale

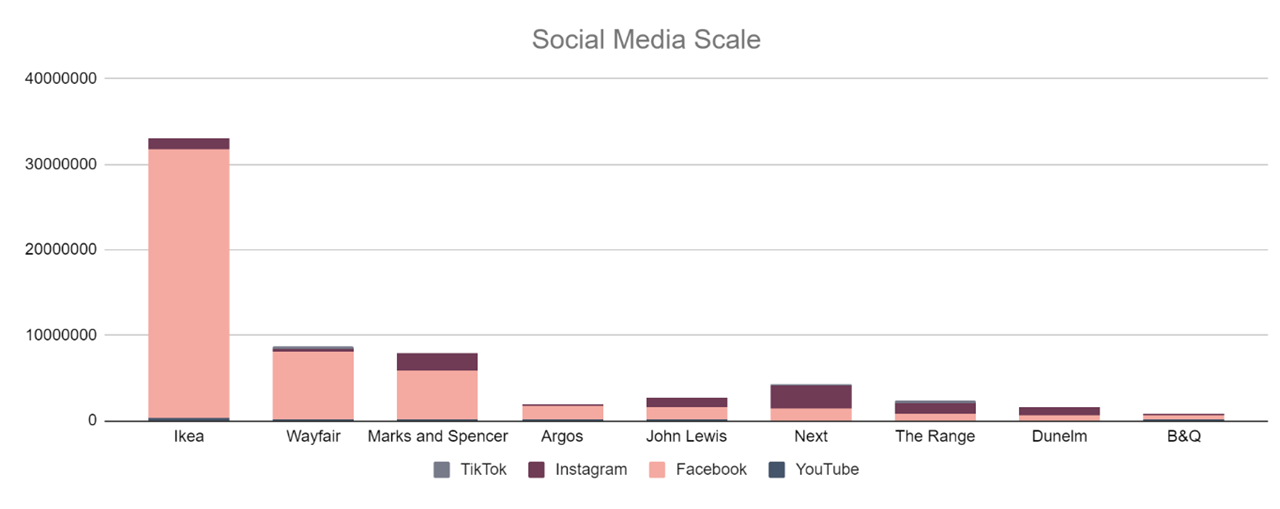

Stepping away from the search landscape and demand to look at the social approach taken by brands within the sector, there are some common patterns and standout approaches. In order to delve deeper into this, we’ve split out the follower counts across platforms for the large retailers and then the rest of the leading furniture brands including some of the strong performers from individual categories.

Large Retailers:

Ikea has established by far the largest social media audience out of the major retailers, largely driven by the scale of their Facebook audience. Out of all the large retailers, the brand has established a community and culture that relates to their brand personality, in addition to how their products fit into people’s everyday lives.

Next have come closest to building a coherent brand and product connection on Instagram, with the largest following of any of the brands studied.

Considering the dominance of Argos across search, their social presence is behind the curve. There is less of a connection to the brand and more a connection to the breadth of products across Argos’s range. In fact, Argos, Dunelm, B&Q and The Range all have dominant search strategies but appear to either struggle, or not prioritise, carrying the same comparative scale across social media.

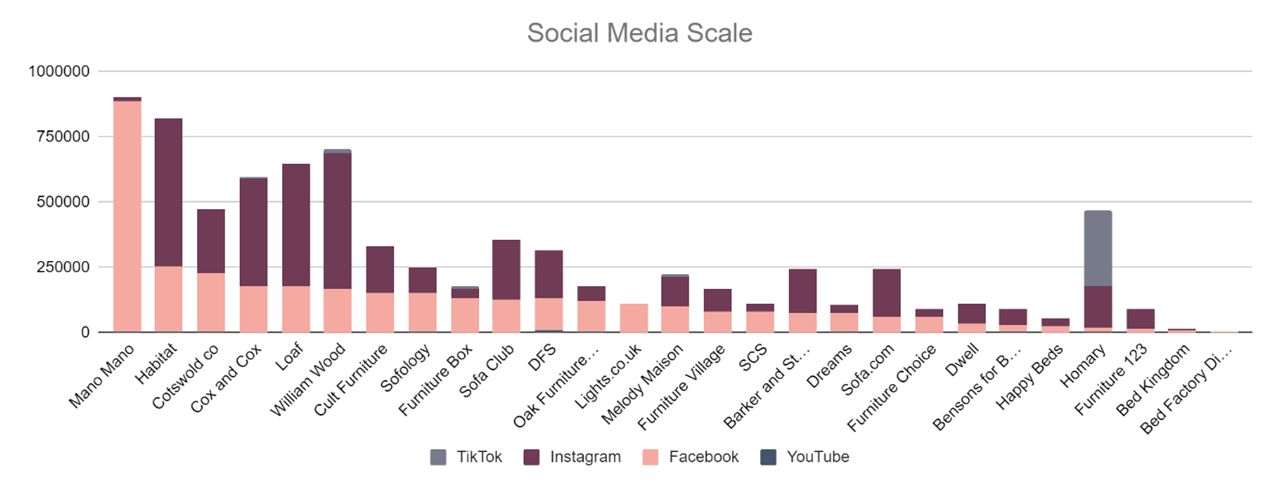

Furniture Specialists:

Across the rest of the furniture specialists in our analysis there are two distinct patterns.

1. Brand led organisations which generally have a larger social following led by a direct-to-consumer approach via Instagram. These include Habitat, William Wood and Cox and Cox.

2. Product led organisations where growth has largely been driven through their search strategies. These include Furniture Village, Oak Furniture Land, Furniture Choice and Furniture 123.

Some organisations fall somewhere in the middle, such as Barker & Stonehouse and Sofology. There are also a couple of exceptions: Homary, which is the most dominant user of TikTok and Mano Mano which has built an enviable following on Facebook compared to comparator brands. Homary has a remarkably simple and repetitive strategy focused on short video creation and an appeal to Gen Z, with unboxing shots and simple styling tips. No other home décor brand has taken such an active role on the platform where engagement rates in home décor content is much higher than other platforms.

Although ManoMano have a high following on Facebook, the majority of the engagement is customer service related and not necessarily positive. They are still a relatively new company in the UK aiming to shake up the DIY and home space, having built the majority of their following and brand awareness in lockdown.

There is a clear distinction between the retailers investing time in building engagement on social media and those just looking to extend their commercial activity to try and drive more sales. Engagement levels can be really high, as long as there is a focus on the customer and what they’re genuinely interested in, with less prioritisation of the direct impact on selling.

Action that matters: For brands that have developed a strong social following and are looking to scale further, now is the time to focus on creative, short-form video content across Instagram and TikTok taking specific note of what trends are creating and driving the high engagement rates across the platforms. If a brand can showcase themselves aligned directly to the consumers’ tastes where the consumer is most comfortable online they will be able to build the brand further as well as a community connected to it and the products.

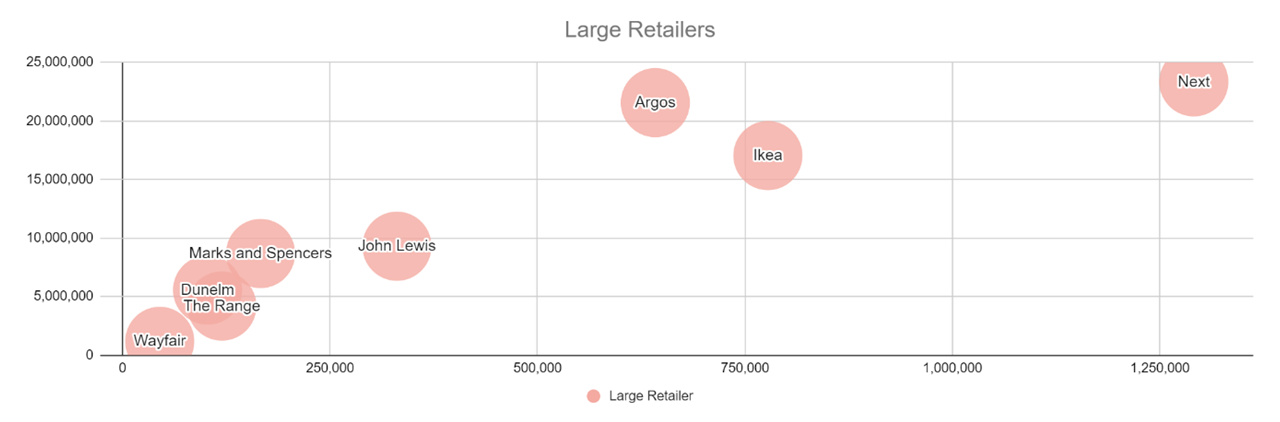

Brand Scale

Finally, we took a look into the brand scale, effectively looking at brand broad match across more than 30 of the largest retailers in the sector. This gives us an indication of each brand’s penetration across the market – how often people look for them alongside their products.

The charts below show the number of associated keywords plotted against the overall estimated volume related to these keywords. It gives a sense of the brand scale in comparison to other retailers in the set.

Next, Argos and Ikea lead the way although we should caveat that ‘next’ has a broader meaning so will capture volume that does not always relate directly to the retailer. It does show that these three large retailers are by far the leading brands within this space, and the likes of John Lewis, The Range and Dunelm have work to do to grow their overall scale to match.

When looking beyond the large retailers towards the furniture specialists, including some of the main DIY retailers which also sell home furnishings, there are only a couple that stand out in having considerable brand volume and many associated keywords. Habitat is the best example of a lasting furniture brand name, despite its commercial troubles in the past it has sustained its brand equity as part of the Sainsbury’s Group.

So, what are the trends that matter in the home furnishings sector? Who stands out from the broad analysis and what key takeaways are there?

Action that matters: If a brand doesn’t have a point of differentiation within the market it will rely on its products to drive that point of differentiation and interest. There is an opportunity within the home furnishings sector to test points of difference across different groups of consumers and for different product sets. Paid media is ideal for this; it allows you to test brand and product messaging from a commercial angle, through paid search, and from a more emotive point of view, through paid social and wider media partners.

The Trends that Matter

After significant analysis, we’ve chunked down the insights to shine a spotlight on four key trends in the sector and what opportunities these trends can highlight to help forge a stronger brand and performance direction over the next few years.

1. Innovation and adaptability: Responding to the changing personality of our homes

Our homes and how we live in them are continuing to evolve and have seen some of the most significant changes in recent years driven by the pandemic, eco consciousness and the cost of living crisis. Retailers need to innovate and adapt to respond to the changing needs of consumers, which include multi functional spaces within the home, an emphasis on sustainable living and products and affordable multi-stage living. Currently, there is one stand out brand that encompasses innovation and adaptability in this sector and that’s Ikea. Ikea’s approach to creative innovation is the reason they continue to perform well across the sector.

Based on our analysis, they ranked almost as consistently as Argos across all of the keyword categories and the associated brand volume is almost as high despite being a pure home furnishings business. Their vision is “to create a better everyday life for the many people” and this focus extends to solving everyday problems across a range of target audiences. They support students on their move out of home, first-time parents and expanding families and they create unique storage solutions to help homes adapt through different phases of life.

Here are our top five pioneering innovations by IKEA:

1. The Ikea Smart Home products and app: Making a connected home affordable and accessible.

2. Ikea Kreativ showrooms and room scanner: Allowing you to design and enhance your own space before making a purchase. This functionality is baked into their shopping app.

3. The University Starter Kits: Ikea understands its audiences and supports them through multiple channels and approaches. Their ‘starting college’ hub and university starter kit boxes are a prime example.

4. Small space solutions: A recent innovation focus on small-space multifunctional furniture design, a reflection of the world becoming more urban.

5. Ikea’s startup collaborations including Space10: Space10 closed this year after a decade of design ideas created exclusively for Ikea. The company spearheads collaboration with startups to continuously solve potential problems of the future.

Ikea is a leading light for the sector in driving forward solutions for how we live today and reflecting the changing needs of different types of customer. This is why it continues to be a place that can both satisfy and reassure as well as surprise and delight the customer.

Action that matters: Create a campaign around the most innovative product line or company initiative as part of a brand building strategy. The campaign should help gain authority, connect with a specific audience and showcase brand progression.

2. Everyone wants to make a house a home: Differentiation is brave

In contrast to Ikea making the ‘wonderful, every day’, the rest of the sector seems set on making a house a home. It seems reasonable, we all want to feel at home in our houses but where is the differentiation? We’ve analysed the language across the straplines, visions and missions of the full list of competitor retailers and were surprised (and a little bit bored) to hear the same message coming from a lot of retailers.

Here are some examples across the leading retailers and brands in the sector:

- Habitat: Make yourself at home

- Dunelm: There’s no place like Dunelm (substitute ‘Home’ at your leisure)

- Wayfair: No Place Like It (substitute ‘Home’ at your leisure)

- Oak Furniture Land: Furniture to grow your home

- Sofology: Feeling at home on a sofa you love

- DFS: Putting your sofa at the heart of your home

We’ve already shown that there isn’t a lot of brand cut through beyond the handful of large brands within the sector. Companies either take a search first route to scale or there are some more emergent brands which take a more direct to consumer approach being more dominant on social media. The latter are seeing more consistent brand growth despite being at a different scale as they are differentiating from the norm, however the majority are competing in the same channels with the same messaging and as demand is squeezed by the cost of living crisis that competition is getting tougher. Reading through the mission statements of these home furnishings companies, almost all want to help everyone create a home by providing a wide range of quality affordable furniture.

There are however signs things are changing. John Lewis announced a new design director and vision for home earlier this year with a simplified and reduced home trends section. This move is to establish an iconic British design aesthetic which is unique in style.

Brands like Loaf, William Wood and The Cotswold Company are driving more emotive, natural and customer centric content without the hard sell, making them clearly emerging brands within the sector.

Going back to the language in the straplines or mission statements, there is a sense of purpose or uniqueness with these brands which is helping to gain them traction:

- Loaf.com: Explore our laidback world.

- William Wood: Elegance for your home.

- The Cotswold Company: A place where memories are made.

Differentiation is brave but now is the time it is most likely to pay off.

Action that matters: Analyse how home furnishing consumers respond to sector specific trends on social media and across industry publications. Identify the different language, trends and potential points of differentiation to test different campaign angles and brand messaging.

3. The omni-channel experience: How to compete against Argos and Dunelm

If there is one approach which sums up the current state of the sector and explains the dominance of Argos and Dunelm it’s ‘omni-channel’. From the latest Mintel report, 48% of Brits bought furniture in the last 12 months, 42% of those consumers bought their furniture in-store. 31% of Brits browsed furniture online via a retailers’ website on a smartphone/tablet. The height of online demand driven by the pandemic is over, the balance has shifted slightly back towards offline purchases.

Based on these shifting consumer behaviours a connected, omni-channel experience is critical for those retailers with both an on and offline presence. Argos have an enviable online experience, an incredibly fast, clean website and a purchase journey that clearly highlights buying and fulfilment options. Dunelm is perhaps a more compelling example showing much more consistent growth with a laser focus on improving its omni-channel approach, since kicking off a programme of significant digital transformation back in 2018. They have improved every aspect of their infrastructure including their site structure, fulfilment processes, product search, checkout security, use of 1st party customer data and click and collect services. Along with the focus on experience, they have ensured price competitiveness and added more choice and freshness to the ranges. This constant focus on improvement across the board has led to a 9% sales jump in its first quarter of this year and it was highlighted as Retail Gazette’s ‘Best Retailer over £500m’.

So, how can other retailers compete with the giants of the sector? Barker & Stonehouse are a great example of a home furnishings retailer who continue to listen to their customers and evolve their stores. The website now holds its own by reflecting the brand narrative and the aesthetic of the stores. They have introduced omni-channel features to the experience with information on where you can see and collect items in stores and at delivery points. They’re not driving for complete domination but they are providing a very cohesive journey both on and offline. The stores and website are places you want to spend time.

Action that matters: The consumer’s buying experience should be made as simple as possible and reflect the choices available to them. Review the buying information around payments, delivery and fulfilment including clear sign posting to relevant store information and click and collect options. Consumers should have access to buying guides, product material specifications and size guides within the product purchase journey. This type of information is a must-have, not a nice-to-have, in order to compete with the top retailers. AR and VR features can help but must enhance the experience as opposed to becoming a gimmick.

4. Affordable luxury: Precision placement in the market

Due to the fragmentation in the market and the large number of niche brands within the sector it’s easy for some companies to go below the radar. We haven’t delved into every sub-category of home furnishings as it is such a vast sector and flooring, curtains and blinds, bathrooms and kitchens all need their own detailed analysis. We have taken a look at home décor as part of the wider sector view as it is an area which is staying relatively stable. Consumers may not have the spending power to invest as much in big ticket items but there is still a buoyant market for smaller luxury items.

One brand which is really resonating with consumers and helping them to reflect a certain look driven by influencers is William Wood mirrors. They have a clear focus on providing elegance for the home and this message is carried across their social channels and through their imagery. They have established a very strong search presence for their niche achieving a higher market share across the home décor category than Argos and Wayfair. They are a rare example of a brand that is managing to deliver a consistent multi-channel brand and performance-based strategy and one of the only brands in the sector gaining some traction on TikTok, which as previously alluded to has by far the highest engagement rate for home décor content.

Action that matters: PR and Rich Media can help to amplify a luxury brand looking to grow their reach without diluting the perception of quality. The two channels can work hand in hand to build brand equity through premium placement with a premium creative approach.

To summarise: Where do the opportunities lie?

For a sector really starting to feel the squeeze of the cost of living crisis, with a hugely competitive and fragmented market, the main opportunities for brands are:

1. Look to satisfy customers’ changing and future needs including multi-functional furniture, smart home integration, home workspaces and character pieces that resonate with a consumer’s personality.

2. Differentiate your brand to appeal to a specific audience, style or product type and own that space.

3. Focus on a complete strategy to satisfy the full customer experience from inspiring the customer with the product design and choice through to the shopping, purchase and fulfilment experience. Consistency is key.

4. Affordable luxury and quality will appeal to customers looking for durable and timeless looks for the home. Consumers have budget, the environment and over-consumption on their minds so appeal to provide products which can reassure the investment.

Growth is predicted to be conservative over the next five years (3.12% CAGR 2023-2028 – Statista) so companies will need to be more dynamic across their whole digital strategy. Reliance in one area will leave brands vulnerable to change and the direction of the major platforms including Google and TikTok suggests the need for a much stronger brand narrative to support search and social strategies.

Latest Insights From The Team.

Explore our team’s latest thoughts and actionable advice from our blog to support your digital marketing strategies.